SARASOTA, Fla. (SNN TV) — For years, Florida’s insurance market has been in crisis.

“Most property insurers wanted to stay clear of Florida,” said Mark Friedlander, the Florida spokesman of the Insurance Information Institute.

Two items – legal system abuse and assignment of benefits claim fraud – ravaged the insurance market, according to III, causing premiums to skyrocket each year.

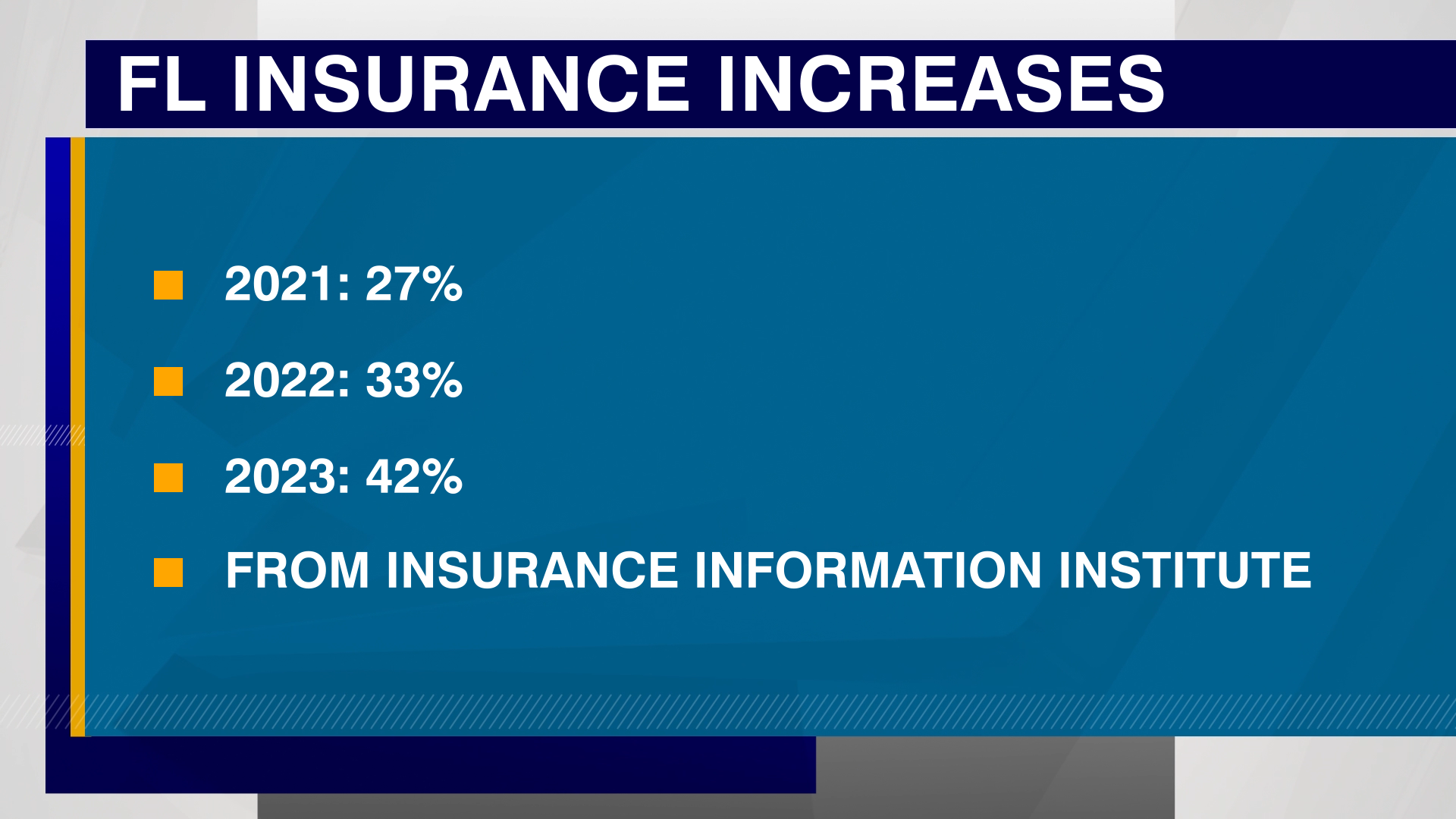

“In 2021, we saw a 27% average increase, 2022 [was] 33%, last year [was] 42%,” Friedlander said. “We saw seven insurers go insolvent in just 13 months between February of 2022 and February of 2023.”

But after the Florida Legislature passed reforms in late 2022 to stabilize the market – by eliminating one-way attorney fees and assignment of benefits for property claims.

“This has led to six companies entering the Florida marketplace. All will be available to consumers in 2024,” said Friedlander. “The Florida property insurance market is improving and in much better condition than it was a year ago.”

More companies entering the market means you’re not necessarily stuck with whatever your renewal rate turns out to be.

“New companies have come into the market. They are bullish at getting your business. Go to a local independent agent [and] ask them to get quotes from these new companies,” Friedlander advised.

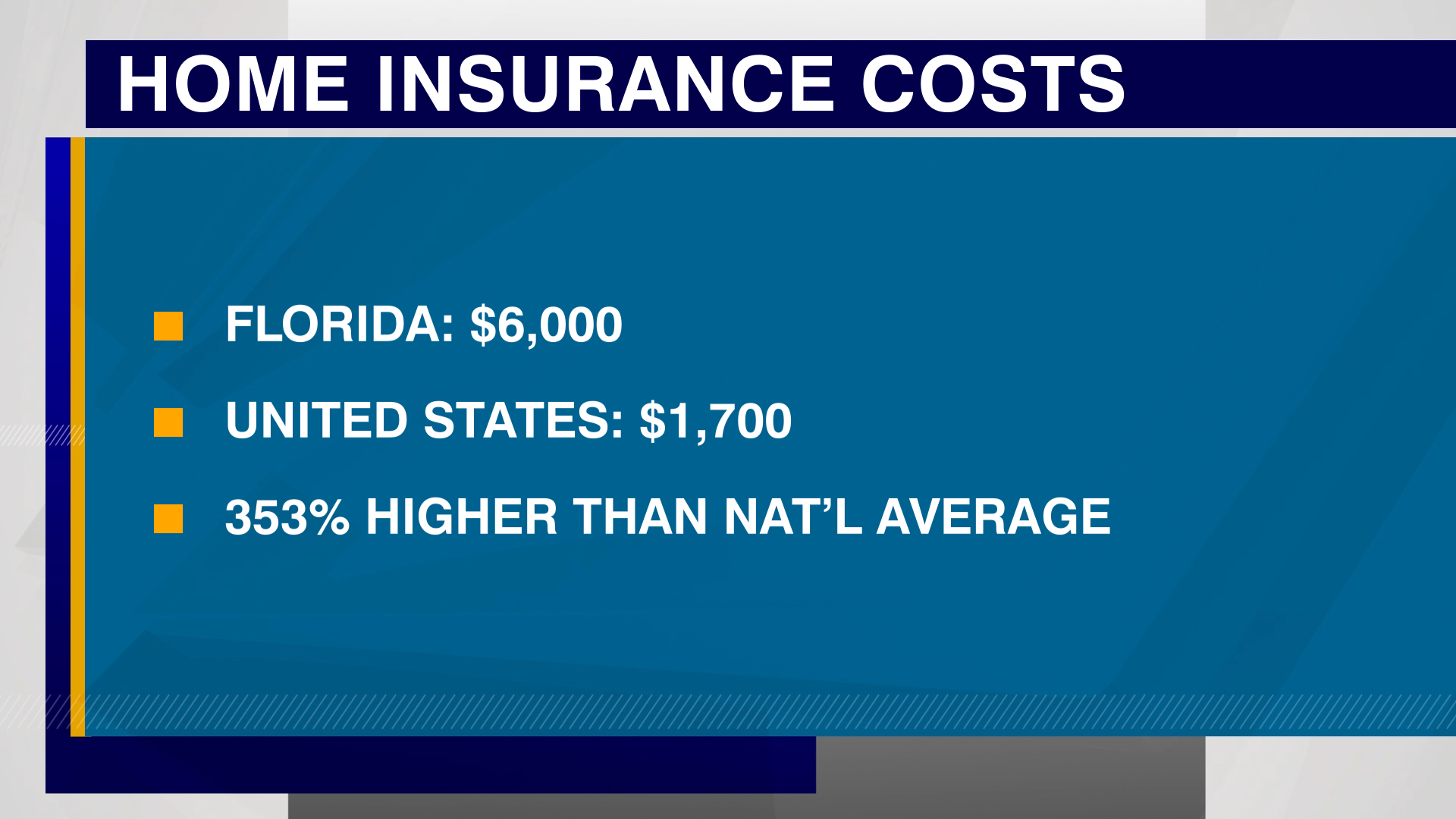

But don’t get too excited yet: more companies writing insurance for homes doesn’t mean rates are coming back down. According to III, premiums remain enormous in Florida.

Could we go hands-off and allow the market to heal, or is there more that needs to be done on the state level?

“We are hearing from some state legislators that not enough has been done, and we understand that because their constituents are very concerned about the cost,” said Friedlander.

The average cost of home insurance in Florida is running at $6,000, the highest average in the U.S. In fact, it’s three and a half times the U.S. average of $1,700.

You’ll likely see a double digit increase again this year because Citizens, the state’s insurance of last resort, just raised their rates in December, and they’re usually around 33% cheaper than private insurance.

“So if Citizens is running at, say, 12% on average, you might see private insurers at 20% or higher,” Friedlander said.

Bottom line: you can shop around more now and decrease your renewal rate, but it’ll take a while before the healthier market translates to smaller increases – not decreases – for you.